Written by: Chloe Silverman, Senior Writer at The Hartford

Reviewed by: Gene Marks, CPA, Author & Small Business Owner

How Much Does Workers’ Comp Pay?

No matter what type of business you run, on-the-job injuries or illnesses can happen. This is where

workers’ compensation insurance can step in and give your employees important benefits. An injured or ill employee can

file a workers’ compensation claim and receive weekly payments to cover medical bills or lost wages. This coverage is also known as workers’ comp insurance and workman’s compensation. Remember, this coverage won’t help if your employee gets a personal injury that’s not related to their work.

Average Weekly Wage

This example can help you learn how to calculate your employees’ average weekly wage:

Your full-time employee made $50,000 last year after working for 242 days. If you divide $50,000 by 242, their average daily wage is $206.61.

Next, multiply $206.61 by 260 (the number of days a full-time employee would work in a year). That should equal $53,718.60.

Finally, divide $53,718.60 by 52 (the number of weeks in a year), to get your employee’s average weekly wage of $1,033.05.

Partial vs Total Disability

The weekly amount your employees receive is also based on the type of injury or illness they have. If they’re partially or totally disabled, they’ll get different benefits than someone with a temporary injury. In fact, a totally disabled employee will typically get 60% or 2/3 of their average weekly wage. Each state also has a maximum weekly rate, so you’ll want to make sure you understand the rules and benefit amount for your state.

If you’re wondering

how long workers’ comp lasts, that also varies. Generally, the more severe a work-related injury or illness is, the longer payments last. If you expect your employee to need future medical treatment beyond regular workers’ comp payments, you may want to advise them to talk to a lawyer for legal advice.

Workers’ Comp Calculator

So, how is workers’ comp calculated? To figure out

workers’ comp premiums, you’ll first need to understand the factors that influence them, such as:

Workmen’s Compensation Calculation

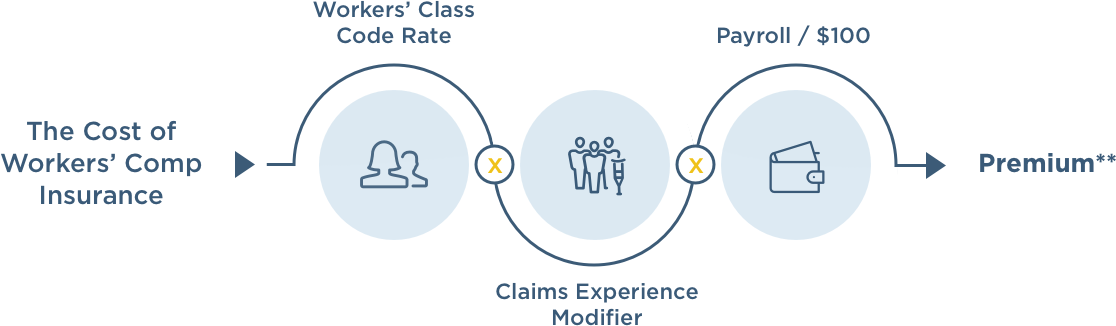

You can estimate your premium with this workmen’s compensation calculation formula:

Each state has its own classification code depending on the type of work performed by your employees. The National Council on Compensation Insurance (NCCI) assigns these codes.

Your state may also determine your business’ unique experience mod by comparing your company to others in your industry.

Your business’ payroll gets multiplied by a rate that matches the class code. Each class code has a rate per $100.

Learn More About Workers’ Compensation From The Hartford

Get a workers’ comp quote today and learn how we can help protect your business.

Last Updated: September 21, 2023

** This is a simplified calculation for educational purposes only. Actual premium calculations can be more complex. Experience mods are subject to state requirements and do not apply to every policy.

Additional disclosures below.

No matter what type of business you run, on-the-job injuries or illnesses can happen. This is where workers’ compensation insurance can step in and give your employees important benefits. An injured or ill employee can file a workers’ compensation claim and receive weekly payments to cover medical bills or lost wages. This coverage is also known as workers’ comp insurance and workman’s compensation. Remember, this coverage won’t help if your employee gets a personal injury that’s not related to their work.

No matter what type of business you run, on-the-job injuries or illnesses can happen. This is where workers’ compensation insurance can step in and give your employees important benefits. An injured or ill employee can file a workers’ compensation claim and receive weekly payments to cover medical bills or lost wages. This coverage is also known as workers’ comp insurance and workman’s compensation. Remember, this coverage won’t help if your employee gets a personal injury that’s not related to their work. So, how is workers’ comp calculated? To figure out workers’ comp premiums, you’ll first need to understand the factors that influence them, such as:

So, how is workers’ comp calculated? To figure out workers’ comp premiums, you’ll first need to understand the factors that influence them, such as: You can estimate your premium with this workmen’s compensation calculation formula:

You can estimate your premium with this workmen’s compensation calculation formula: